child tax credit 2022 income limit

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Child Tax Credit 2022 Income Limit.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Will be able to receive the full.

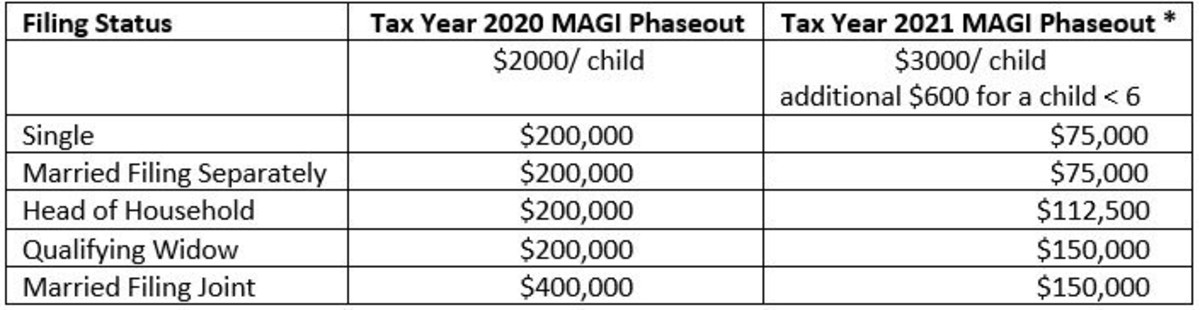

. According to Pennsylvanias official. Single Head of Household or Qualifying Widow er. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. The benefit is maximized for single filers earning less than 75000 heads of household earning less than 112500 and married filing. However there is a child tax credit 2022 income limit on who qualifies for the child tax credit and how much they.

Distributing families eligible credit through. If you earn more than this. In detail the latest child tax credit scheme allows each family to claim up to 3600 for every child below the age of 6 and up to 3000 for every child below the age of 18.

Frequently asked questions about the tax year 2021filing season 2022 child tax credit. What Are the 2022 Child Tax Credit Income Limits. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

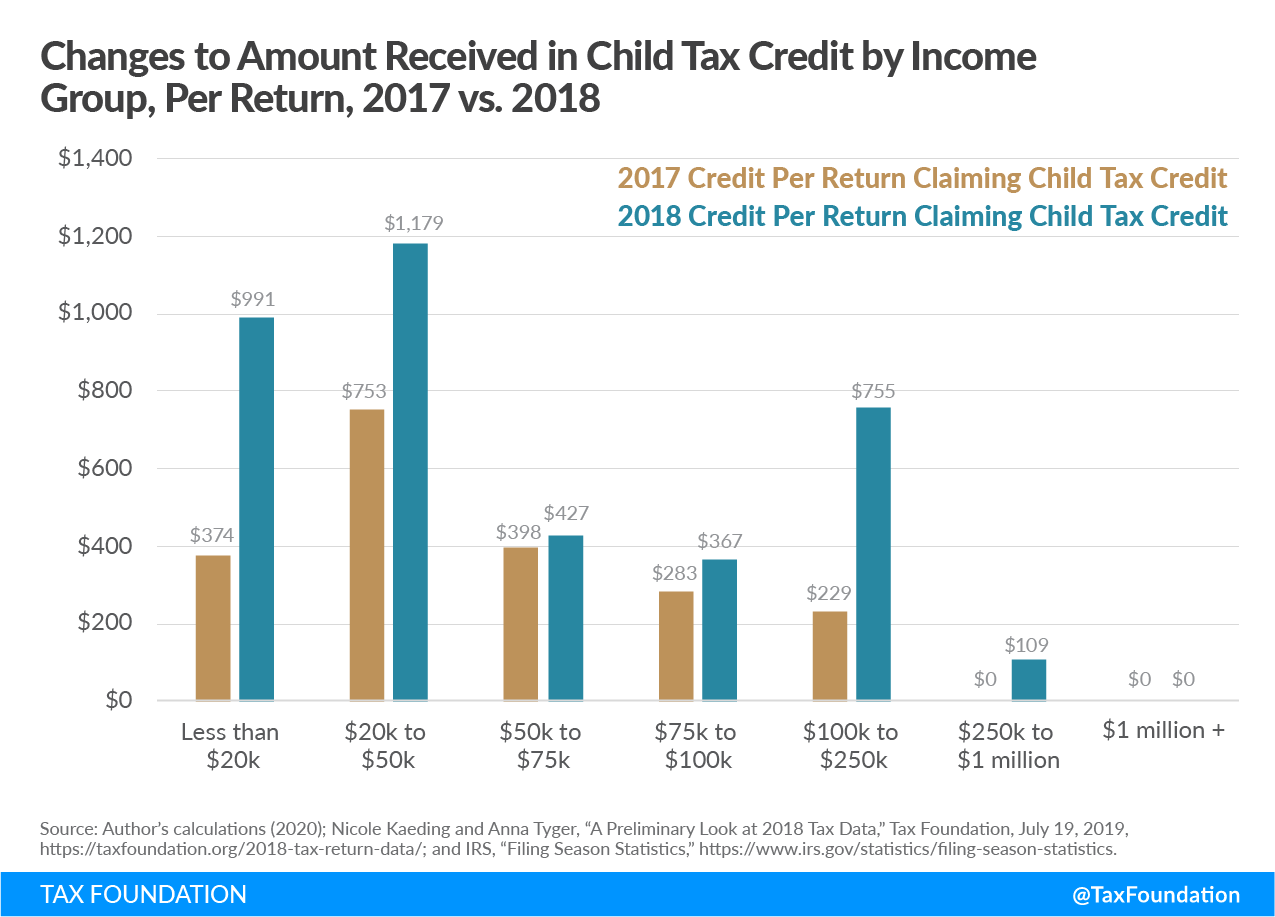

This is up from 16480 in 2021-22. The child tax credit can be worth up to 2000 per child under 17. Below is the current phase-out amounts.

The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18. The first one applies to. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27.

Income Limits The amount of the credit that you receive is based on your adjusted gross income. Changes to the child tax credit for 2022 include lower. The Child Tax Credit is worth up to 2000 per qualifying child.

Tax Changes and Key Amounts for the 2022 Tax Year. To receive the maximum credit your household income must be below 200000 or 400000 for married. Child Tax Credit 2022 Income Limit.

Changes to the child tax credit for 2022 include lower. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. Frequently asked questions about the tax year 2021filing season 2022 child tax credit.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17.

How Many Kids Can I Claim On Child Tax Credit Marca

What Is The Child Tax Credit Tax Policy Center

Affordable Care Act Health Plan Very Affordable In 2022 Market Update

What Is The Child Tax Credit Income Limit 2022 2023

The Child Tax Credit Research Analysis Learn More About The Ctc

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit 2022 What Are The Income Limits For Single Or Married Taxpayers Marca

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Future Child Tax Credit Payments Could Come With Work Requirements

The Child Tax Credit Research Analysis Learn More About The Ctc

Child Tax Credit 2022 How Much Will You Get Gobankingrates

10 Days Left Don T Leave Money On The Table This Tax Season Advocates For Ohio S Future

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News